Table of contents

Toggle- What Is the Purpose of Liability Insurance Included With the Access Pass?

- How much does this insurance cost?

- Frequently Asked Questions

- True or False: The insurance included in my trail access permit only covers me while I’m on trails.

- Can I receive compensation from the SAAQ if I’m in a snowmobile accident?

- Does this insurance cover loss or damage to my snowmobile?

- Am I required to keep the insurance included in my trail access permit?

- How do I cancel the insurance included in my permit?

- Can I buy a trail access permit without insurance?

- I’d like to keep the liability insurance included with my trail access permit. How do I cancel the one I already have with my snowmobile insurer?

- I currently have a $2,000,000 liability limit. Is this option available through trail access?

- Do all snowmobilers pay the same insurance premium?

- Does a similar insurance program exist elsewhere?

- Conclusion

- Keep Reading

Over the years, I’ve noticed that many snowmobilers confuse different types of insurance policies, especially regarding the coverage provided with our trail access pass. With the 2024 annual trail access pass presale period starting from October 1 to December 9, snowmobilers need to know more about the liability insurance attached to trail access permits. So here is a Q&A that covers all the essential information every snowmobile enthusiast should know.

What Is the Purpose of Liability Insurance Included With the Access Pass?

When trail access with liability insurance was first introduced in 1998, studies showed that many snowmobilers in Quebec were riding trails without this protection. This situation put other snowmobilers at risk. In case of an accident between two snowmobiles, the injured parties might find themselves in a difficult position if the at-fault snowmobiler lacked insurance. They would be unable to receive compensation if the at-fault party were insolvent, and costly legal proceedings would likely follow. Since 1998, all snowmobile club members have been able to enjoy their favourite sport with greater peace of mind, thanks to this program.

How much does this insurance cost?

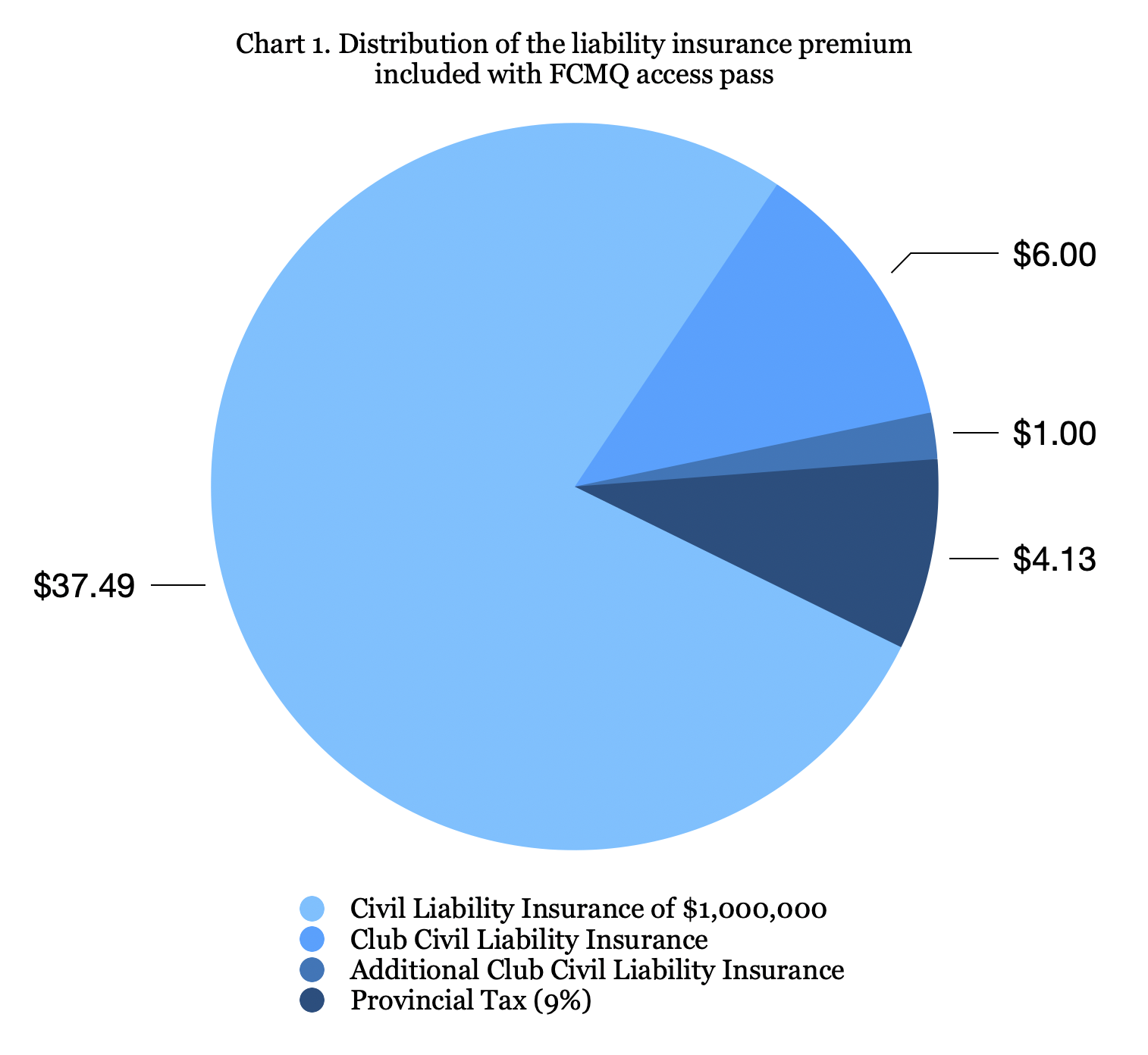

The FCMQ’s insurance broker negotiated excellent rates with several insurance companies operating in Quebec. Currently, Intact Insurance, Canada’s largest insurer, offers the most favourable policy conditions for Quebec snowmobilers. The premium is structured as follows:

Note: These amounts were in effect in 2024 and may change in the future.

So, the premium paid by the snowmobiler for their snowmobile is $34.39 + 9% tax = $37.49, taxes included. This represents a substantial saving compared to the average premium paid by snowmobilers in Quebec. The remainder of the premium is your contribution to your club’s civil liability insurance.

Frequently Asked Questions

True or False: The insurance included in my trail access permit only covers me while I’m on trails.

FALSE! Your liability insurance covers you anywhere in Canada and the United States, whether on trails or off, on private or public land, in parking lots, on public roads, and beyond.

Can I receive compensation from the SAAQ if I’m in a snowmobile accident?

NO. The SAAQ provides no compensation for injuries in a snowmobile accident, except when the accident involves a moving vehicle covered by the plan.

Does this insurance cover loss or damage to my snowmobile?

NO. The liability insurance included with trail access only covers damage to others’ property or injury to others. Damage to your snowmobile, such as collision, rollover, fire, or theft, is covered by the insurance policy you have for your snowmobile, available through your broker or usual insurer. You must maintain this policy if you wish to protect your vehicle.

Am I required to keep the insurance included in my trail access permit?

NO. Although Intact Insurance offers a very advantageous premium for Quebec snowmobilers, you can cancel this insurance within ten days of purchasing your permit. After this period, you can still cancel at any time, though part of the premium will be retained based on the time you used the insurance, calculated from the purchase date. Note that the refundable premium within the ten-day window is $37.49, including tax, covering your snowmobile’s portion.

How do I cancel the insurance included in my permit?

There are two ways to cancel the insurance. First, fill out and mail the cancellation form into the distribution guide provided when you buy your permit. Alternatively, you can complete the electronic cancellation form on the FCMQ website at www.FCMQ.qc.ca.

Can I buy a trail access permit without insurance?

YES. You can buy a trail access permit without insurance by completing a special form on the FCMQ website. However, there will be a $23 handling and shipping fee, and delivery may take up to 21 days. The most economical, simple, and quick way is to buy a permit WITH insurance and request an online cancellation within ten days of purchase.

I’d like to keep the liability insurance included with my trail access permit. How do I cancel the one I already have with my snowmobile insurer?

Contact your broker or insurer and inform them that you have liability coverage through the snowmobile trail access program. Ask them to cancel Part A — Civil Liability, but let them know you wish to keep Part B, which covers property damage to your snowmobile (collision, rollover, fire, theft, vandalism, etc.).

I currently have a $2,000,000 liability limit. Is this option available through trail access?

YES! You can request an increase to a $2,000,000 limit anytime. Download the form available on the FCMQ website at www.FCMQ.qc.ca and send it by mail with a $21 check (tax included) for each snowmobile you own.

Do all snowmobilers pay the same insurance premium?

YES. That’s part of what makes this program unique. Members of each FCMQ-affiliated snowmobile club pay the same liability insurance premium, regardless of the snowmobile model, its year, the driver’s age, their driving record, or their claims history.

Does a similar insurance program exist elsewhere?

YES. A similar program was introduced in 2017 by the Fédération québécoise des clubs quad (FQCQ).

Conclusion

I hope this article has answered your questions about liability insurance on trail access permits. Looking forward to seeing you on the trails!

—